- Howie Fenton

- |

- July 09, 2024

At the recent IPMA 2024 Educational Conference, I had the opportunity to help lead a breakout session exploring the emerging trends shaping our industry. These evolving trends are significantly transforming the business landscape and have been making themselves known over the past several years.

During the pandemic and subsequent years, technological advancements and innovations slowed down. However, the pace of change has been steadily accelerating since. The resulting trends can be perceived as either challenges or opportunities, depending on your perspective. The crucial question is: Can you leverage them to your advantage?

In this blog, we delve into seven key trends — some familiar, others newly emerging. Let’s take a look.

1. Cost-Consciousness

At the IPMA 2024 Educational Conference, Greg Cholmondeley, Production Workflow Principal Analyst at Keypoint Intelligence, presented findings from the 2024 Keypoint Intelligence Software Investment Study. During the session, he revealed that rising costs are a top concern in the in-plant business.

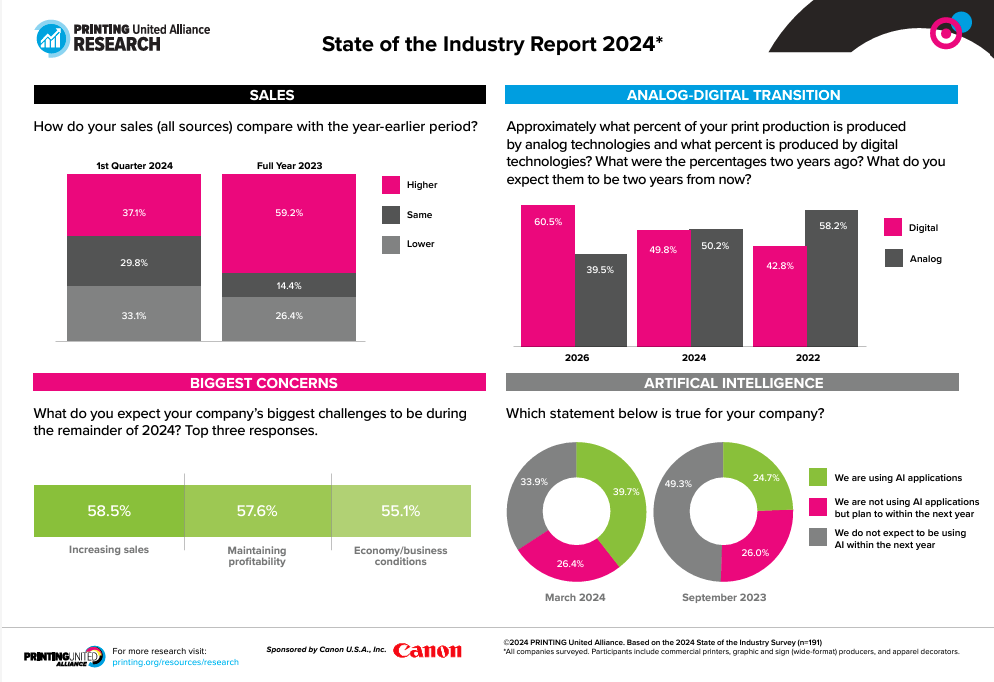

This finding aligns with those in the PRINTING United Alliance’s State of the Industry Report 2024. "Operating cost inflation has moderated but continues to pressure profit margins...with various costs, including labor, transportation, energy, postage, insurance, and debt service, continuing to rise and soft markets limiting cost pass-through, even moderate inflation is enough to pressure margins," the report states.

As a result, companies are increasingly focused on cost-effective solutions to improve their bottom lines. This includes leveraging new technologies such as automation tools and Web to Print systems and integrating artificial intelligence (AI) into software to streamline operations and reduce costs. By optimizing processes and eliminating inefficiencies, companies can remain competitive and profitable despite economic pressures.

This trend underscores the importance of continuous improvement and innovation to maintain cost efficiency while delivering high-quality products.

2. Automation

Automation in software and hardware is significantly transforming the printing industry. Software automation includes tools for Web to Print, workflow management (including print MIS and PDF software), customer relationship management (CRM), and enterprise resource planning (ERP). These tools streamline administrative tasks, order processing, and inventory management, increasing efficiency and reducing human error.

Web to Print systems are becoming increasingly popular as they allow customers to design, customize, and order print products online. This trend streamlines the estimating, ordering, and billing process; improves customer convenience; and ensures brand consistency.

Web to Print platforms support efficient management of print collateral and other printed materials, reducing the time and effort required for manual order processing. They also provide businesses with valuable data analytics to track customer preferences and optimize their offerings. The integration of Web to Print systems with e-commerce platforms enhances the overall customer experience, driving sales and fostering customer loyalty

3. Artificial Intelligence

When Gartner made their predictions for 2024 and beyond, they explored how Generative AI (GenAI) has revolutionized our thinking on virtually every subject. The release of ChatGPT in late 2022 marked 2023 as the year everything changed. And just as they are across other industries, AI and automation are revolutionizing the print industry by optimizing workflows, reducing manual intervention, and lowering operational costs.

AI-driven automation can handle complex tasks, streamline production processes, and enhance print quality by making real-time adjustments. Predictive maintenance powered by AI minimizes downtime by anticipating equipment failures before they occur. And AI can analyze customer data to generate personalized print materials, further enhancing the value proposition of printed products.

Companies not embracing AI risk falling behind as it transitions from a luxury to a critical component of strategic operations.

4. Industry Consolidation

The print industry is experiencing consolidation as companies seek to combine forces, expand their offerings, and/or enter new market segments. This trend is driven by the need to diversify revenue streams and achieve economies of scale. By consolidating, companies can enhance their capabilities, broaden their customer base, and better position themselves to compete in a dynamic market.

Take the book industry as an example. “Change continues to rock the book manufacturing business,” The Target Report recently reported. “Contracts for book printing and bindery services have declined as publishers pull back on new orders and work off the excess inventory that built up in response to demand during the COVID years. Print-on-demand book technologies are placing further downward pressure on traditional book manufacturing. Although there is widespread confidence that the printed book will survive the digital onslaught better than many other forms of print, there are shifts and cracks in the book printing world.”

In the in-plant industry, it’s rare that two in-plants are located close enough to each other to consolidate into one location. More often, consolidation occurs indirectly — for example, school districts can take over production work for local districts or universities provide fleet management to local schools.

5. Labor Shortages

Labor shortages remain one of the biggest challenges for printers and in-plants — even ranking ahead of increased energy prices and bureaucratic burdens.

At drupa 2024, Heidelberg announced a study of 700 printers, reporting that nearly one in two lack suitably skilled staff. Exile Technologies has also reported on the repercussions of this trend within the print industry. “As industries grapple with an aging workforce, shifting demographics, and evolving skill requirements, the manufacturing labor shortage has emerged as a critical issue with far-reaching implications,” Exile reported. “This shortage is a localized concern and a global phenomenon impacting sectors across the board.… Attracting and retaining skilled workers amidst the manufacturing labor shortage is a top priority for print businesses across the United States.”

Labor shortages continue to challenge the printing industry, prompting companies to adopt various strategies to attract and retain talent. That might mean leveraging software automation to reduce the need for manual labor, adjusting hiring criteria to include younger talent and those from non-traditional sectors, and focusing on training programs to develop the skills of new recruits.

Innovative recruitment practices, such as social media and freelancing platforms, are also gaining traction. Additionally, competitive salaries, inclusivity, environmental consciousness, and clear career growth opportunities are becoming essential to attract and retain a skilled workforce. Companies are also exploring flexible work arrangements and mentorship programs to create a more appealing work environment.

6. Inkjet Press Adoption

In the PRINTING United Alliance’s State of the Industry Report for the third quarter of 2023, they reported that inkjet presses were the industry’s third most desired investment behind bindery equipment and workflow software. This is consistent with reporting from Marco Boer, conference chair for the Inkjet Summit 2024, who reported that much of the recent growth has been in the commercial market.

Inkjet production printing is gaining traction, with many in-plants transitioning to inkjet presses to replace multiple toner machines. Much of this interest results from less expensive sheet-fed devices and machines with smaller footprints, often due to offline finishing.

In-plant investments tend to occur after commercial investments. This shift reduces space requirements, streamlines staff, and increases printing speed, allowing in-plants to reclaim previously outsourced tasks. Companies adopting inkjet technology are finding it enhances their capacity, reduces costs, and improves workflow efficiency.

This trend is expected to grow as more businesses recognize the benefits of inkjet presses and integrate them into their operations.

7. Resilience Building

Building organizational resilience is increasingly recognized as a critical strategy for businesses. Resilience refers to an organization's ability to withstand and recover from disruptions, shocks, and unexpected events.

The COVID-19 pandemic starkly highlighted the fragility of many systems, prompting leaders to prioritize resilience. Businesses are now focusing on building resilience to manage future challenges such as staffing issues, economic downturns, and shifts in demand. This requires a multi-faceted approach that includes:

- Diversifying product and service offerings: Companies are expanding their product lines and services to reduce reliance on a single revenue stream.

- Integrating innovations: Innovations in technology and processes play a crucial role in resilience. For example, combining softwares such as CRM and Print MIS can help identify buying trends and customers to target new offerings.

- Developing comprehensive risk evaluation plans: Businesses are investing in detailed risk evaluation and management plans that help identify potential hazards and develop strategies to mitigate them.

- Cross-training employees: Investing in cross-training programs is essential for building resilience. Cross-training enables employees to perform multiple roles, which helps maintain productivity during staff shortages or unexpected absences.

- Creating flexible workflows: By implementing flexible workflows businesses can adapt quickly to changing market conditions. You can plan for shifts in demand, equipment downtime, or staffing issues.

- Building strong supplier relationships: Establishing robust relationships with multiple suppliers is vital for resilience. This became clear during the paper shortage and should become the blueprint for working with all suppliers.

Conclusion

The business landscape is evolving rapidly, with technological advancements and innovations accelerating post-pandemic. Adapting to rising costs through cost-effective solutions and leveraging new technologies can help businesses improve their bottom lines.

Automation continues to transform operations, enhancing efficiency and reducing human error. AI's role in optimizing workflows and predictive maintenance is proving indispensable. Industry consolidation is reshaping market dynamics, pushing companies to diversify and scale efficiently. Labor shortages demand innovative recruitment and retention strategies to secure skilled talent. Inkjet press adoption is revolutionizing production capabilities, and the emphasis on building resilience is preparing businesses to withstand future disruptions.

The key to thriving in this rapidly changing environment is a proactive approach to these trends. By embracing continuous improvement, investing in technology, and fostering a resilient organizational culture, companies can maintain their competitive edge, deliver high-quality products, and navigate the complexities of the modern market.

7 Trends Currently Impacting the In-plant Industry

From cost-consciousness and industry consolidation to the prevalence of automation and AI and the rise of inkjet press adoption, seven trends are shaping the in-plant industry today. Some are new, while others have been gradually emerging for years but are now impossible to ignore. How can your business leverage these trends to continue to thrive?